Why Vietnam?

Opportunity to “lay golden eggs” for Medtech startups

I. Overview of MedTech Market in Vietnam:

-

Market Size:

According to AmCham Vietnam, healthcare expenditures per capita in Vietnam are predicted to rise 9.2 percent per year between 2009 and 2025, reaching USD 184 in 2021 (USD 18 billion for the entire nation) and USD 262 by 2025 (USD 26 billion of the total market) (International Trade Administration 2021). Particularly, health expenditure in Vietnam is valued up to $15.4 billion in 2020, equivalent to 5.7% of total GDP (Nextrans 2021). Private healthcare expenditure is expected to expand at a 7.5 percent CAGR, owing mostly to increasing insurance coverage for citizens (International Trade Administration 2020).

The MedTech Industry can be defined as the consolidation of all tech-enabled services, platforms, and medical equipment that eases the burdens of disease and sickness prevention, diagnosis, and treatment. A smart healthcare industry has been strongly initiated by Vietnam’s companies and government which includes disease prevention, medical examinations and treatment, and health management. The four primary areas in Vietnam’s digital health market are: Health Information Technology, Telemedicine, Consumer Health Electronics, and Healthcare Big Data & AI-based products and services, which are currently in the early stages of development (KPMG 2020). Specifically, since June 2018, a target for 95% of the Vietnamese population having electronic medical records has been set out by the Government. While telemedicine solutions are in a “pilot” phase, AI and Big Data’s application still remains limited.

-

Healthcare structure in Vietnam:

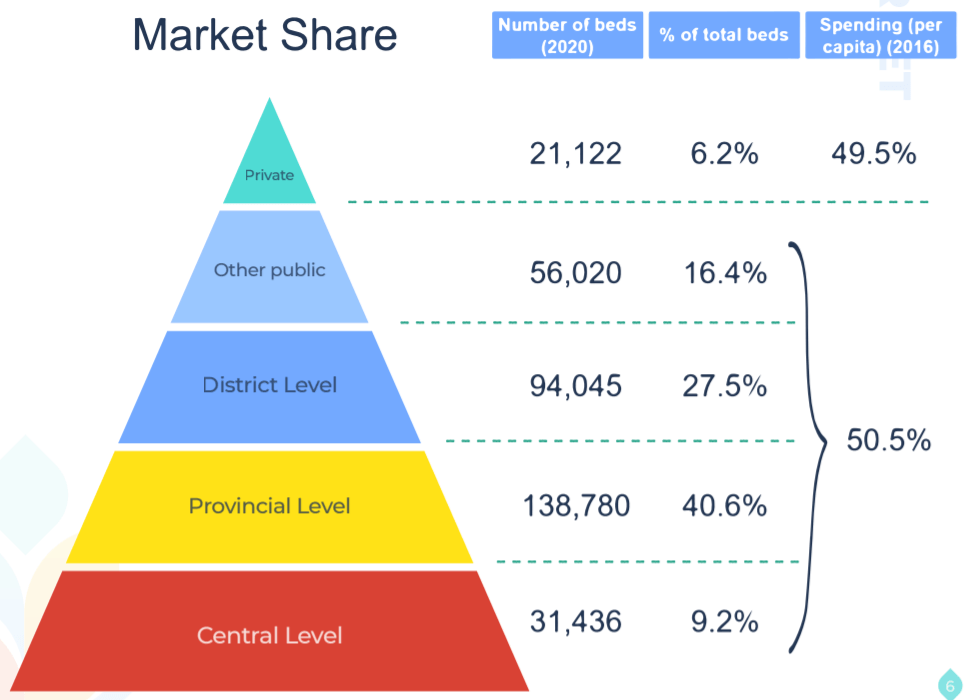

Vietnam’s healthcare market share is currently divided equally between the private sector and the state (in terms of spending). Spending on private sectors accounted for 50.5% of total spending on health though private sectors only account for 6% of the total number of hospital beds. Vietnam has about 1,531 hospitals, of which more than 86% are public hospitals and nearly 14% are private hospitals, mainly concentrated in large urban areas such as Ho Chi Minh City. Ho Chi Minh, Hanoi and Da Nang. 1,318 public hospitals are managed according to a hierarchical system, classified by central, provincial, and district or commune levels (Electronic Media – Communist Party of Vietnam 2020).

Figure 1: Market Share of Vietnam’s healthcare industry (Truong et al. 2020)

Digital health ecosystem in Vietnam not only includes the government and associated organizations, but also has private entities participating in diverse sectors such as telecommunications, IT, and insurance. The diversity in actors results in a cooperative ecosystem between the government and private players which may accelerate innovation and growth of the sector. Despite being in its early stages in Vietnam, MedTech presents itself as an appealing sector for local and foreign startups, and conglomerates.

II. Key areas in Digital Health:

-

Health information technology

- Vietnam’s health information system is making headway: For patients and diseases, most medical facilities in Vietnam still employ paper-based medical records. Nevertheless, Vietnam has established the target of promoting Electronic Health Records (EHRs) since June 2018. According to the government’s EHR deployment strategy (Decision No. 5349/QD-BYT), at least 80% of individuals in provinces and central-affiliated cities will have EHRs in the near future, with a goal of reaching 95% of the population nationally by 2025.

-

Telehealth / Telemedicine

- Since the start of the pandemic in 2020, telehealth infrastructure has greatly improved. By 2026, telehealth is predicted to be worth $185.6 billion. WebRTC, an open-source API-based system that connects web browsers and mobile applications, allowing for the transmission of audio, video, and data, is one of the most significant technologies that will be required.

-

Artificial Intelligence (AI) and Big Data in Healthcare:

- Prior to the COVID-19 pandemic, Artificial Intelligence (AI) and Big Data has been in the nascent stages of its utilization that are only used by only a few hospitals out of nearly 1,400 hospitals in Vietnam. AI and machine learning have shown to be beneficial not only in the prevention and treatment of COVID 19, but also in the long-term impact on physical and mental health.

-

Consumer health electronics:

- Regarding the popularity of wearables and IoT technologies, their potential proves to be significant in the healthcare industry. Particularly, At the start of 2021, there were 11.3 billion IoT devices connected. The worldwide IoT medical devices market is expected to grow from USD 26.5 billion in 2021 to USD 94.2 billion by 2026. The ability to remotely monitor a patient’s state throughout the day, or for an individual to check their own status, makes this technology extremely significant.

III. Opportunities & Challenges:

According to a report by YCP Solidiance (2018), private hospitals now have relatively advanced, modern health management systems compared to public hospitals for a number of reasons. Higher income patients are willing to pay for higher quality and modern healthcare services. With digitization as a competitive advantage, private hospitals have stepped up investment and upgraded their digital infrastructure. These hospitals are equipped with products and services from leading information and technology companies such as Oracle or SAP with standardized systems. As a result, the implementation of digital tools in private hospitals is less complicated than in public hospitals. Along with the macroeconomic changes, MedTech proposes promising prospects of development in the future. Furthermore, given intensive government support and present challenges (overcrowding hospitals, obsolete medical equipment, shortage of staff), MedTech emerges as an optimal solution towards these problems. Despite prolific spaces for development and growth opportunities, MedTech still presents considerable challenges regarding the traditional habits of operation, cumbersome and complicated administrative processes, and non centralized data as well as tool usages in the healthcare industry. Notably, there still exists doubts around technology’s reliability and capabilities, lack of information security and professional ethics which accounts for reluctance in adopting technology in the medical field.

IV. References:

Electronic Media – Communist Party of Vietnam 2020, Thị trường y tế số Việt Nam: thách thức và cơ hội cho các nhà đầu tư, https://dangcongsan.vn, viewed 21 April 2022, <https://dangcongsan.vn/phat-huy-thanh-tuu-y-te-trong-cham-soc-suc-khoe-nhan-dan/tin-tuc/thi-truong-y-te-so-viet-nam-thach-thuc-va-co-hoi-cho-cac-nha-dau-tu-569646.html>.

International Trade Administration 2020, VIETNAM HEALTHCARE SECTOR, www.trade.gov, viewed 21 April 2022, <https://www.trade.gov/market-intelligence/vietnam-healthcare-sector>.

― 2021, Vietnam – Healthcare, www.trade.gov, viewed 21 April 2022, <https://www.trade.gov/country-commercial-guides/vietnam-healthcare>.

KPMG 2020, Market Intelligence Report Digital Health in Vietnam.

Nextrans Vietnam 2021, Vietnam Industry Report 2021, Nextrans.

Truong, T, Nguyen, M, Nguyen, N & Hoang, C 2020, Digital healthcare in Vietnam, October, Med247 Academy.

YCP Solidiance 2018, Vietnam’s aging population drives healthcare cost, ycpsolidiance.com, viewed 21 April 2022, <https://ycpsolidiance.com/article/vietnams-aging-population-drives-healthcare-cost>.