Why are signs pointing to a recession in 2023

While some industries are still recovering from the pandemic’s financial impact, there’s another growing threat on the horizon.

In 2023, Vietnam will continue to confront several difficulties, including low export growth, a high-interest-rate environment, persistent global inflation warnings, tightened liquidity, and rising pressures in the real estate sector due to mounting non-performing loans.

The manufacturing and business activities of labor-intensive industries such as textiles, garments, leather footwear, wood processing, and mechanics are expected to continue experiencing a reduction in orders, leading to ongoing hardships.

There are various reasons behind these challenges. Businesses primarily face difficulties due to reduced consumer demand from major export markets such as the United States and Europe, resulting in cuts to both existing and new orders. Additionally, factors such as military conflicts between Russia and Ukraine, strategic rivalries among major countries, escalating trade protectionism, high inflation, surging prices, and tight monetary policies have led to a decline in global commodity demand. As a consequence, the import demand of significant markets has decreased, directly affecting domestic enterprises by reducing their orders, thereby forcing them to downsize their workforce.

Furthermore, businesses in Vietnam are also affected by the impact of global conditions, leading to increased prices of raw materials. The instability of some imported inputs has disrupted production stability, making it challenging to ensure a stable supply and purchasing power within the country.

In this article, we will explore the top 5 industries that will be most affected by the impending challenges in Vietnam during 2023. Additionally, we will provide recommendations to help businesses safeguard their bottom line and navigate through this economic downturn. By understanding the potential impacts, industries can proactively prepare and mitigate the effects of the anticipated global recession.

1. Real Estate

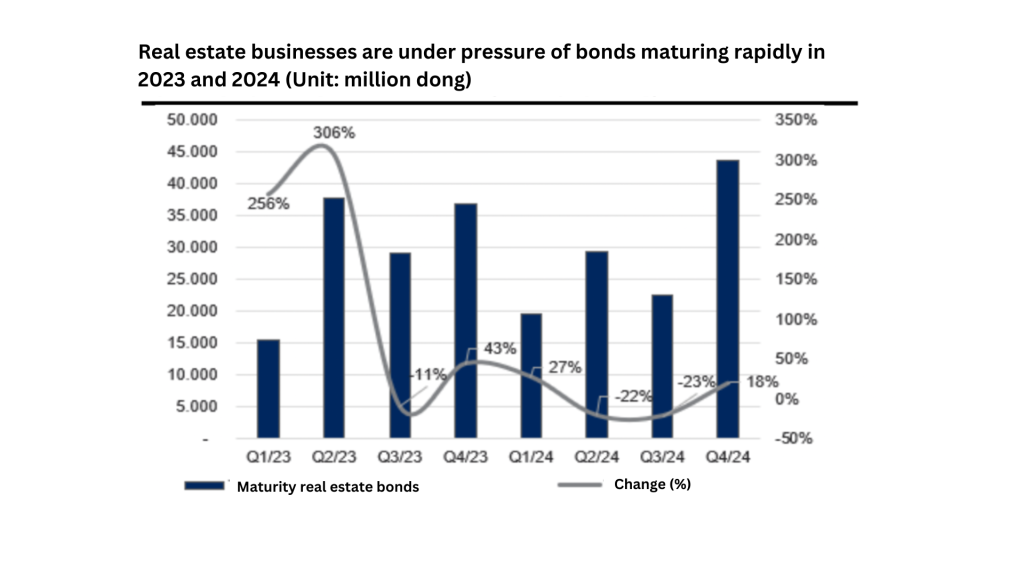

Vietnam’s real estate market is experiencing significant challenges in 2023. The scarcity of real estate supply and housing is a major concern, with a limited number of licensed, under-construction, and completed projects. According to the Hanoi Stock Exchange, as of the beginning of March, at least 10 property developers were seeking a delay in redeeming bonds or paying interest due to their constraining cash flow. The market primarily caters to high-income individuals, leaving a shortage of affordable housing for social and worker segments.

According to VNDirect, in mid-February 2023, 54 corporate bond issuers announced late payment of interest, raising concerns about liquidity. VNDirect estimates that about VND 23 trillion of bonds from these organizations will mature in 2023 (equivalent to 90% of real estate companies).

Source: VNDIRECT RESEARCH

Real estate businesses in Vietnam face challenges in accessing capital, managing costs, and dealing with legal and planning issues. Difficulties in accessing capital, high-interest rates, and soaring input material prices force businesses to reduce investment and downsize their workforce, impacting workers’ financial well-being.

The legal framework for real estate in Vietnam is confusing and incomplete, leading to market instability. Proposed amendments aim to align land prices with the market value and simplify administrative procedures. Unreasonable planning regulations hinder real estate development. Flexibility in planning laws is needed to avoid inefficiencies.

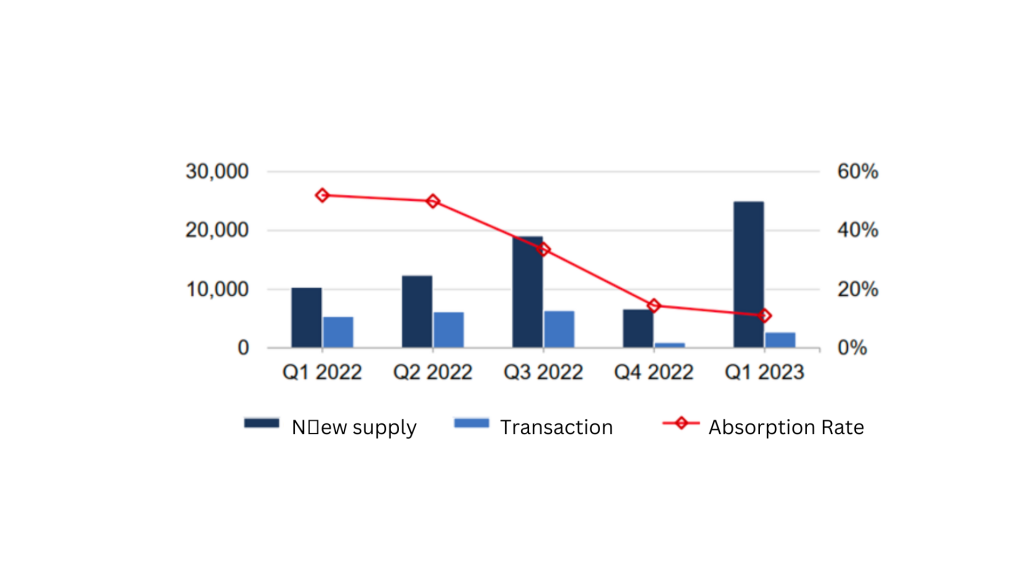

The transaction rates of various real estate segments such as residential properties, tourism, and resorts not show significant improvement. Despite some transactions taking place, they are still relatively low.

Compared to the challenging “freeze” cycle of 2011-2013, there is a positive aspect in the current state of Vietnam’s real estate market. VNDirect Research found that there are now more listed real estate companies than there were during the 2011-2013 period.

Despite facing challenges from domestic firms, the Vietnamese real estate market continues to attract foreign investors and investment funds, according to industry insiders. VN Express reports the 2023 Asia-Pacific Investor Intentions Survey by CBRE Vietnam revealed that Ho Chi Minh City and Hanoi are among the top 10 most attractive destinations for cross-border investment. Ho Chi Minh City even ranked third on the list, surpassing Australia for the first time.

2. Manufacturing

Vietnam’s exports in the first 5 months of this year have declined by 11.6% compared to the same period last year, reaching 136.17 billion USD. This drop can be attributed to weakened external demand, placing significant pressure on the manufacturing-dependent economy.

The decline in Vietnam’s manufacturing industry in early 2023 can be attributed to both internal and external factors. Intense competition among major economies, economic rivalries, and trade wars have played a role. The Russia-Ukraine conflict has led to high input prices for fuel, energy, and logistics globally, affecting domestic production costs.

Additionally, high inflation, tight monetary policies, and reduced consumer spending on non-essential goods in key markets like the US and EU have resulted in decreased export orders for Vietnamese businesses. The reopening of China has also increased competition for countries exporting similar goods, including Vietnam. Domestically, although purchasing power has partially recovered, it remains weak, limiting production stimulation. Challenges in accessing capital, high-interest rates, and elevated input costs further hinder manufacturing, particularly in processing and manufacturing industries. Besides, inflationary pressure and rising interest rates have also impacted the consumption of luxury goods.

Moreover, consumer habits developed during the Covid-19 period continue to affect purchasing patterns. However, Vietnam is predicted to record a rise of 6.6% in industrial production in 2023, according to S&P Global Market Intelligence. The manufacturing sector of Vietnam continues to be the lead investment highlight for FP.

3. Construction

Vietnam’s construction industry in 2023 has been greatly impacted by various factors, resulting in significant fluctuations in construction material prices and project implementation costs. The market faces both stable and volatile elements, leading to uncertainties.

The war between Russia and Ukraine since 2022 has caused a surge in raw material prices, especially gasoline, oil, and metals, resulting in increased steel and freight prices in the Vietnamese market. The recovery of the Chinese construction market has further driven up steel prices in neighboring markets. Consequently, domestic steel prices have increased again after a temporary cooling-off period in late 2022.

The government’s efforts to tighten mining activities for construction materials, coupled with the implementation of the North-South Expressway projects, have caused scarcity in materials such as sand and stones. As these materials are vital for producing other construction materials, their prices have risen alongside the growing demand.

In addition, government regulations limiting lending and the scrutiny of major real estate corporations for potential management errors and loan-related administrative issues have added challenges. Numerous large projects have been stalled or suspended due to budget constraints and pending legal procedures.

Overall, Vietnam’s construction industry in 2023 faces significant obstacles, including material price fluctuations, resource scarcity, lending restrictions, and intense competition. These challenges have hindered industry growth and profitability, requiring companies to navigate a challenging operating environment.

4. Retail

According to economists, the retail industry in the world is among the industries most affected by the recession in 2023. If retailers don’t start building recession-proof strategies early on, they may be forced to shut down their operations.

The impact of recession on the retail industry goes beyond decreased consumer spending. It’s also forecasted that the industry will face unexpected layoffs in 2023. Due to low consumer spending and inventory surplus, retailers will lay off employees as a cost-cutting measure to reduce their overhead costs.

Retail sales in Vietnam increased by 11.5 percent year-on-year in May 2023, the same pace as in the prior month. This was the 18th consecutive period of growth in retail trade while remaining at the softest pace since March 2022, amid intense cost pressures and high borrowing costs.

However, The retail industry in Vietnam has experienced significant growth in recent years, with the rise of modern shopping centers and the increasing popularity of e-commerce.

5. Aquaculture Industry

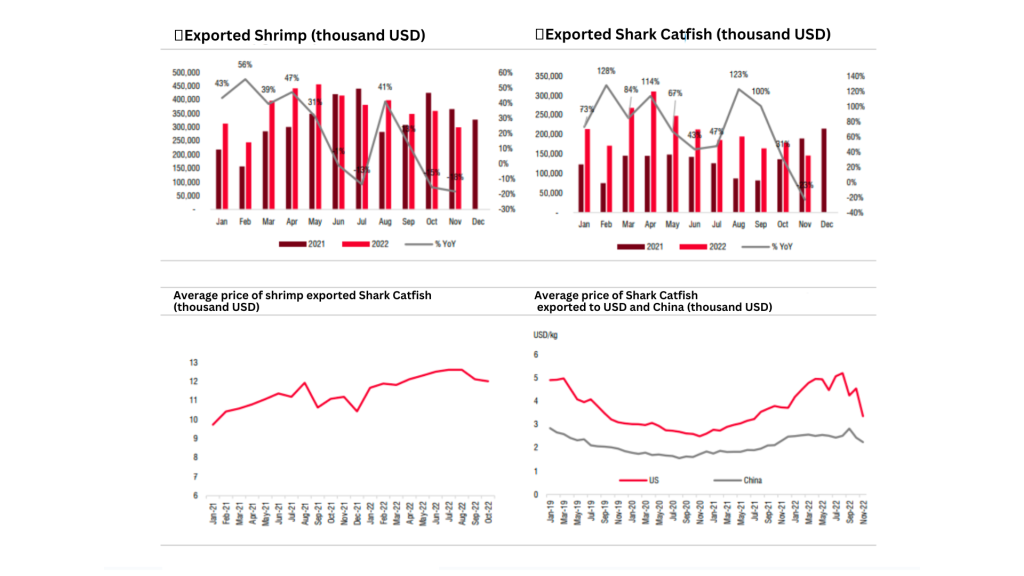

The aquaculture industry in Vietnam is facing significant challenges in 2023, with a sharp decline in seafood exports and decreased demand in key markets.

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), seafood exports in April 2023 continued to plummet by 28% compared to the same period in 2022, reaching only $810 million. Seafood enterprises are under immense pressure due to a decline in consumption and a significant drop in export prices. Domestically, the industry is burdened by high production costs, particularly for feed, breeding stock, and other essential expenses.

The US market is experiencing rising food prices and decreased consumption, while the Chinese real estate market remains sluggish, impacting industrial profitability and hindering economic recovery. As both major markets decline, Vietnamese tra fish exports have been severely affected, with sales reaching less than $600 million in the first four months of 2023, a 46% decrease compared to the same period in 2022.

In addition, inflation is expected to pose a challenge to the seafood industry in 2023, as slow inventory turnover persists. Despite upcoming major seasonal events such as Easter in the US, these events are unlikely to reduce the high inventory levels. It is projected that inventories will be completely cleared in the third quarter of 2023, with order placements expected to commence at that time.

Source: VASEP SSI Research

Average selling prices may decrease by 20-30% compared to the previous year, and the cost of aquaculture feed is also expected to decline accordingly. With slow growth in order placements, the supply of both shrimp and raw fish is not expected to be in shortage. Therefore, the prices of shrimp and raw fish are forecasted to slightly decrease due to weak demand until the first half of 2023.

Financial costs are anticipated to remain high throughout the year, impacting net profit margins, especially for companies with high leverage, such as IDI. As a result, SSI experts predict that companies may announce negative profit growth in 2023.

Despite the challenges, the aquaculture industry still holds optimistic hopes for positive signals from markets with more stable economies, less affected by inflation, such as ASEAN, the Middle East, and CPTPP countries. In particular, China’s removal of import regulations such as testing, disinfection, and quarantine requirements will alleviate a major bottleneck, expanding export opportunities for Vietnamese seafood in this market, according to VASEP’s assessment.

Reference

Chanthavong, A. (2023, April 21). Recession 2023: The Top 5 Industries That Will Be Affected. ProcurementIQ. Retrieved June 6, 2023, from https://www.procurementiq.com/blog/recession-2023

Daniel, M. (2022, November 28). Top 5 Industries Most Affected by Recession in 2023. KDCI Outsourcing. Retrieved June 6, 2023, from https://www.kdci.co/blog/top-5-industries-most-affected-by-recession-in-2023/

Ngành nào sẽ là điểm sáng tăng trưởng trong năm 2023? (2023, January 27). VietnamBiz. Retrieved June 6, 2023, from https://vietnambiz.vn/nganh-nao-se-la-diem-sang-tang-truong-trong-nam-2023-202311992428489.htm

Ngoc, B. (2023, March 16). Retail giants ramp up Vietnam investment. VIETNAM ECONOMIC NEWS. Retrieved June 6, 2023, from https://ven.vn/retail-giants-ramp-up-vietnam-investment-47013.html

Nhóm ngành nào sẽ hưởng lợi lớn trong năm 2023? (2022, December 10). BizLIVE.vn. Retrieved June 6, 2023, from https://nhipsongkinhdoanh.vn/nhom-nganh-nao-se-huong-loi-lon-trong-nam-2023-post3105045.html

VNDirect: Định giá ngành bất động sản Việt Nam đang rẻ đến 44% so với trung bình 3 năm, song áp lực vẫn còn nhiều trong 3-6 tháng tới. (2023, March 7).

CafeBiz. Retrieved June 6, 2023, from https://cafebiz.vn/vndirect-dinh-gia-nganh-bat-dong-san-viet-nam-dang-re-den-44-so-voi-trung-binh-3-nam-song-ap-luc-van-con-nhieu-trong-3-6-thang-toi-176230307093252023.chn