WHY VIETNAM?

‘Promised land’ for Fintech bloom and thrive in Southeast Asia

Under the profound impacts of COVID-19, 2021 has created a momentum in the global digitization process, affirming a strong foundation for the robust rise of the FinTech field worldwide. This year also witnessed the outstanding development of Vietnam’s FinTech market, proven by the surging number of digital financial services users, increasing foregin investments and supportive government policies. Therefore, Vietnam becomes the forefront of FinTech growth with more diversified and enhanced products. So, along with the hype of thriving Vietnam’s Fintech and global digitalization, where is Vietnam on the world FinTech map and what makes Vietnam an appealing FinTech destination for investors both internationally and domestically?

1. Overview of FinTech in the world and in Vietnam:

In 2021, FinTech companies in the Asia-Pacific region received an investment of $27.5 billion with a record of 1,165 deals. Despite lagging behind 2019’s peak, the total investment was approximately twice the $14.7 billion in 2020. In the first half year 2021, investment was robust, led by $2.7 billion acquisition of Japan-based BNPL firm Paidy by PayPal, a $600 million PE investment in India-based Pine Labs, and large VC funding rounds by India-based BharatPe ($395 million), Razorpay ($375 million), and OfBusiness ($325 million).

Google said that 2021 is also a leap year for Vietnam’s Fintech market when the Internet economy is worth 21 billion USD, ranked 70th on the global rankings and 14th out of 50 in Asia. In recent years, the Vietnamese Fintech field has shown great potential when, together with Singapore and Indonesia, contributing to the common market share of Southeast Asia. With more diversified industries, Vietnam’s FinTech market experienced a considerable growth in the number of startups, reaching a 215% milestone in the period from 2015-2020 (Saigon Entrepreneur Newspaper 2021).

2. FinTech’s startups and companies in Vietnam:

Remarkably, the number of Fintech startups in Vietnam has always increased year by year. While in 2015 the whole market had only 39 companies (this number increased to 74 respectively in 2017, and 124 in 2019), up to now, it is estimated that there have been more than 150 companies participating in the Vietnam Fintech field (Dan Tri 2021). Besides, Vietnam has positioned itself as the third country in terms of the capital amount pouring into Fintech companies (Findexable 2021). Among the Fintechs in Vietnam today, about 70% are startups. In general, a total of 48% of companies are engaged in payments, providing customers and retailers with online payment services or digital payment solutions, such as: 2C2P, VTPay , OnePay, VTCPay, BankPlus, VinaPay, VNPay, Senpay, NganLuong, ZingPay, BaoKim, 123Pay, etc.

Figure 1: Vietnam FinTech Startup’s Map 2021 (TechInAsia 2022)

Regarding the types, E-wallet and online payment takes up a significant part in the FinTech market (31%), followed by P2P Lending (17%) and Blockchain (13%).

Figure 2: FinTech Vietnam Market in 2021 (Dan Tri 2021)

3. Common sectors:

From 2017 to 2021, digital payments in Vietnam witnessed a steady and rapid increase in its transaction value, reaching $12,922 million in 2021 (previously $9,985 million in 2020). Following the present momentum, digital payment in Vietnam has its value increase to $22,056 million in 2025 (Iris 2021). Amidst of the epidemic, according to a Visa survey, Vietnamese customers are progressively prioritizing the usage of e-wallets and contactless payments. It was discovered that 57% of respondents had up to three e-wallet apps, and 55% prefer an app that can execute all transactions. A plethora of e-wallets, notably MoMo, Moca, ZaloPay, Viettel Pay, Payoo, ShopeePay, and, most recently, MobiFone Pay, are accessible in the market, with several incentives to entice clients, making the market more crowded than ever (The Ministry of Finance E-portal 2021).

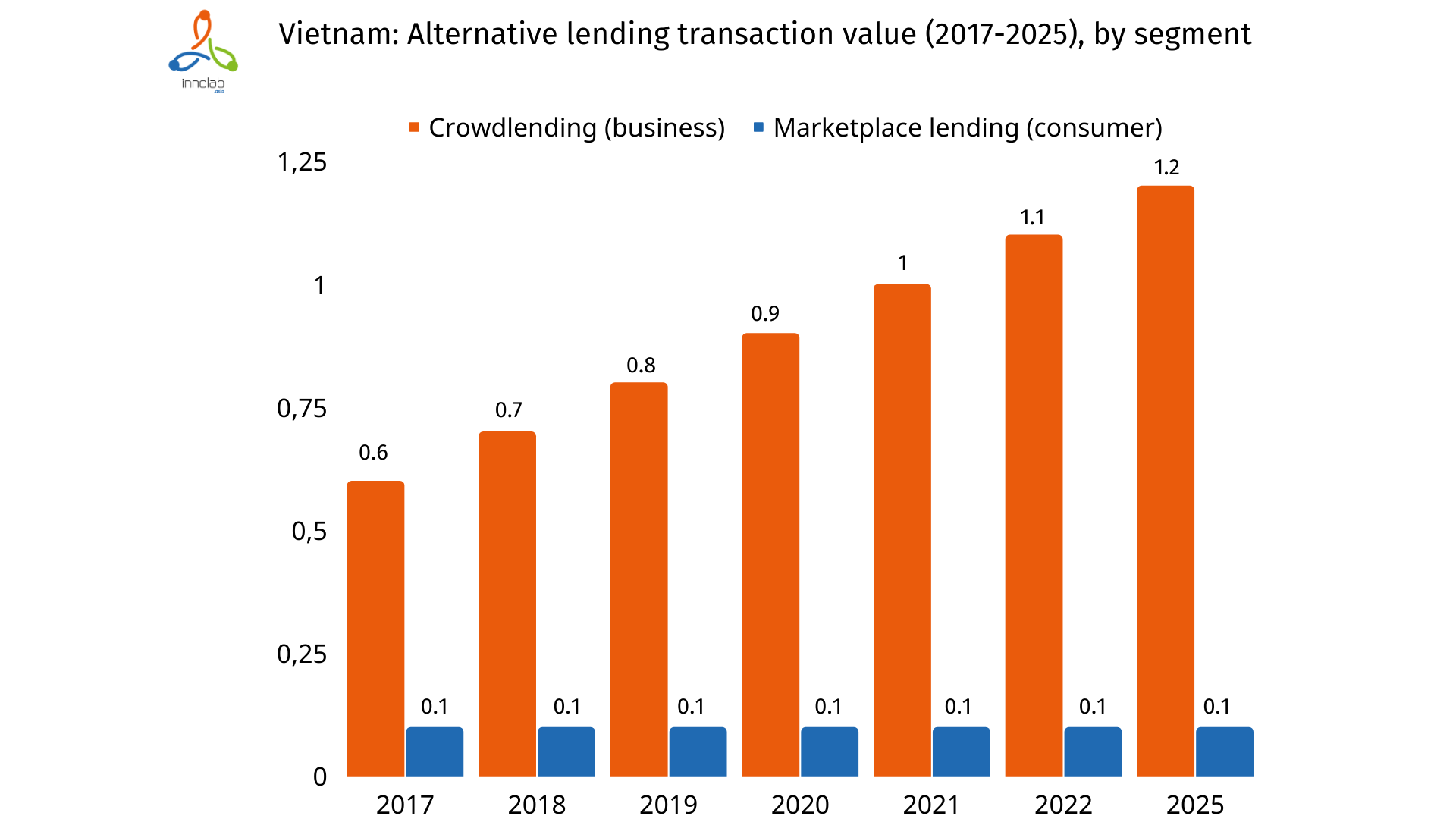

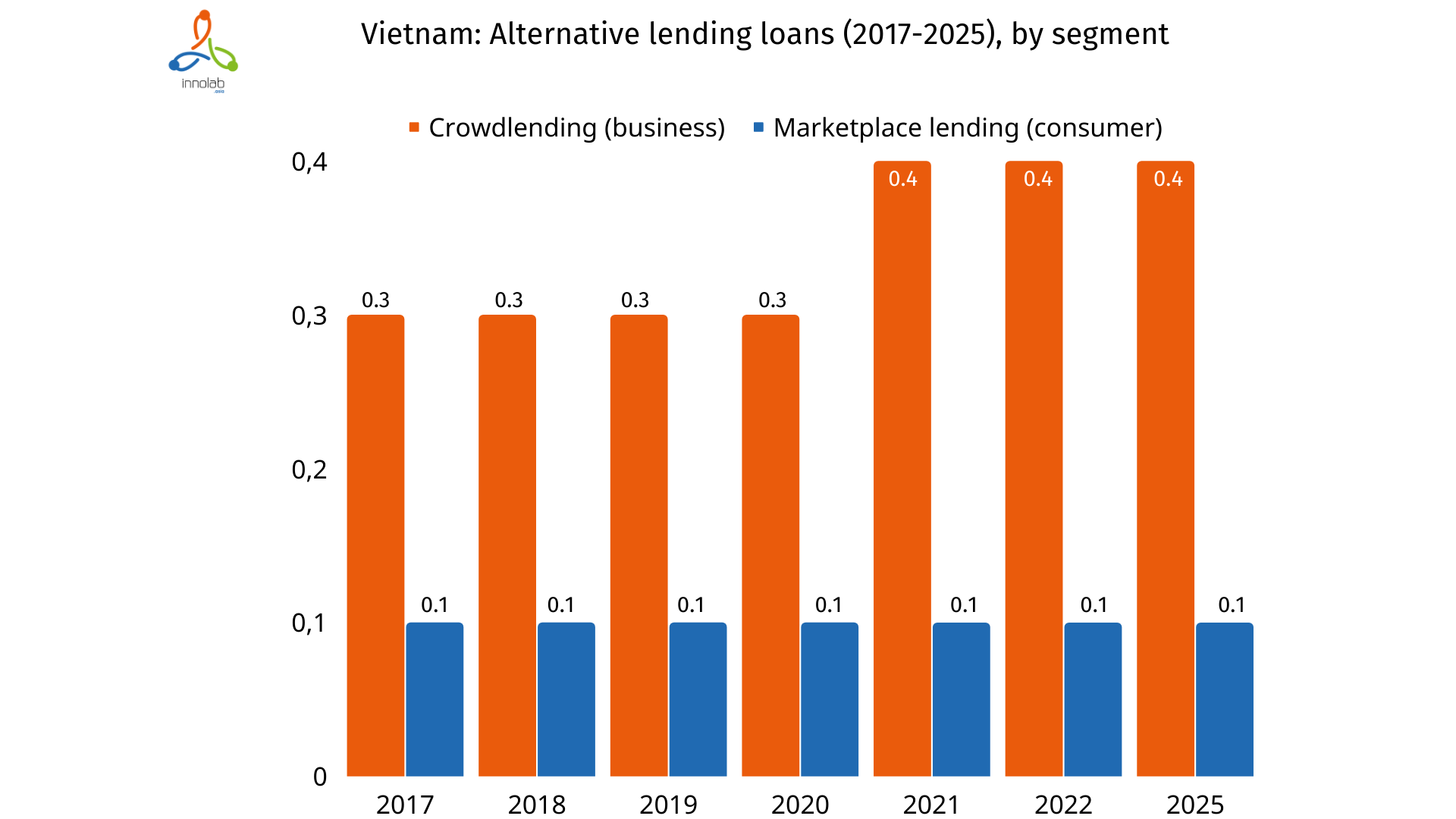

Although banks are considered as the current dominator in the lending market, non-bank financial institutions enjoy rapid growth thanks to their access to a significant number of underbanked and unbankable customers (FiinGroup 202). According to the Statista Report, there are two lending segments in Vietnam: Crowdlending and Marketplace lending. The transaction value was at $0.6 million, and $0.1 million in 2017 for Crowdlending and Marketplace lending respectively. In 2020, while Crowdlending’s transaction value surged 50% to reach $0.9 million, the Marketplace lending remained the same at $0.1 million. From 2017 to 2021, the average financing per loan in alternative lending in Vietnam climbed gradually, in which Crowdlending exhibited a modest growth, and Market Lending stayed stable.

Figure 3: Alternative lending transaction value 2017-2025 (projected) by segment (Iris 2021)

Figure 4: Alternative lending transaction loan 2017-2025 (projected) by segment (Iris 2021)

Research from CB Insights demonstrates a quadrupled funding amount in Blockchain/Crypto from $3.1 billion in 2020 to $15 billion in 2021’s first nine months (Vietnamnet 2022). Regardless of market volatility, cryptocurrencies brought tremendous profits to investors with some currencies posting gains of at least 5,000 per cent in market value (Vietnam News 2021). Particularly,Vietnam is considered as a bright spot in the global Blockchain in 2021 where many Vietnamese enterprises have been creating a foothold in the international market. According to a survey from Chainalysis, a blockchain analytics business, Vietnam ranks fourth among the major nations in terms of bitcoin income, behind China, Japan, and South Korea. Specifically, Vietnamese investors have gained $400 million from Bitcoin alone in 2020, ranking 13th in the world (Vietnam News 2021). Besides, Vietnam demonstrates a high level of cryptocurrency adoption as reported by the Chainalysis (2021).

4. FinTech Development Potential in Vietnam as PROMISING:

With favorable conditions concerning demography and environment, FinTech presents a promising development potential in Vietnam. Vietnam has a high proportion of young population which are in the golden population structure till 2039 (Vietnam General Statistics Office 2020). Furthermore, statistics show that Vietnam has about 64 million Internet users, ranking 6th in the Asia-Pacific region and 13th in the world. Young people’s apprehension of information technology, the booming e-commerce, the low percentage of people with bank accounts, etc are favorable factors for the development of financial and banking services as well as Vietnam FinTech platform in the future (Vietnam Science and Technology Forum 2021). Since there exists a positive relationship among income, education level, fintech awareness and fintech adoption (Morgan & Trinh 2020), Vietnam, as a rising country in both economic and literacy aspects, will inevitably thrive on the FinTech platform.

5. FinTech Development Challenges in Vietnam as FIERCE:

Experts say that Vietnam’s Fintech is in the early stages of development, so it is inevitable that the number of technology businesses will increase. PwC Vietnam recognizes that MoMo, ZaloPay, and Moca are the three leading e-wallets in the market, currently accounting for more than 90% of the market share. This means that the pie is not really too big for other businesses, if there is no distinct advantage. Fintech companies also face the proliferation of mobile network operators. Besides, the Fintech market is increasingly competitive with the entry of commercial banks that are in the process of digitization, so digital banks need to create more imprints to take the lead. Therefore, with increasingly fierce competition in Fintech and non-traditional services, M&A or increasing cooperation and multi-industry combination can be an optimal solution for FinTech companies in the near future to maintain a competitive position for Fintech companies.

Reference list

- Chainalysis 2021, The 2021 Global Crypto Adoption Index: Worldwide Adoption Jumps Over 880% With P2P Platforms Driving Cryptocurrency Usage in Emerging Markets, Chainalysis, 14 October, viewed 1 March 2022, <https://blog.chainalysis.com/reports/2021-global-crypto-adoption-index/>.

- Dan Tri 2021, ‘Thị trường Fintech Việt Nam 2021: Tiềm năng của công nghệ đầu tư tài chính’, Báo điện tử Dân Trí, viewed 1 March 2022, <https://dantri.com.vn/kinh-doanh/thi-truong-fintech-viet-nam-2021-tiem-nang-cua-cong-nghe-dau-tu-tai-chinh-20211108131226658.htm>.

- FiinGroup 2021, Key Rating Rationales of F88 and Alternative Lending Sector Outlook, FiinGroup, viewed 1 March 2022, <https://fiingroup.vn/upload/docs/fiinratings-online-seminar-2110.pdf>.

- Iris 2021, Fintech in Vietnam Report 2021 | Iris Marketing Agency, Iris, viewed 1 March 2022, <https://iris.marketing/fintech-vietnam-report>.

- Morgan, P & Trinh, L 2020, ‘ADBI Working Paper Series FINTECH AND FINANCIAL LITERACY IN VIET NAM Asian Development Bank Institute’, viewed 1 March 2022, <https://www.adb.org/sites/default/files/publication/616781/adbi-wp1154.pdf>.

- Saigon Entrepreneur Newspaper 2021, ‘Bùng nổ thị trường Fintech Việt Nam’, Doanh Nhân Sài Gòn Online, viewed 1 March 2022, <https://doanhnhansaigon.vn/ngan-hang/bung-no-thi-truong-fintech-viet-nam-1108835.html>.

- TechInAsia 2022, Tech in Asia – Connecting Asia’s startup ecosystem, www.techinasia.com, viewed 1 March 2022, <https://www.techinasia.com/visual-story/key-players-vietnams-fintech-battleground>.

- The Ministry of Finance E-Portal 2021, ‘Covid-19 gives boost to e-wallet market’, mof.gov.vn, viewed 1 March 2022, <https://mof.gov.vn/webcenter/portal/vclvcstcen/pages_r/l/detailnews?dDocName=MOFUCM206776>.

- Vienamnet 2021, ‘Việt Nam và cơ hội tỷ USD để phát triển nền kinh tế Blockchain’, VietNamNet, viewed 1 March 2022, <https://vietnamnet.vn/vn/cong-nghe/ung-dung/viet-nam-va-co-hoi-ty-usd-de-phat-trien-nen-kinh-te-blockchain-807642.html>.

- Vietnam General Statistics Office 2022, KẾT QUẢ NGHIÊN CỨU CHUYÊN SÂU TỔNG ĐIỀU TRA DÂN SỐ VÀ NHÀ Ở NĂM 2019, Gso.gov.vn, viewed 7 March 2022, <https://www.gso.gov.vn/wp-content/uploads/2020/12/Thong-cao-bao-chi-Hoi-nghi-Cong-bo-ket-qua-nghien-cuu-chuyen-sau-TDT-Dan-so-va-nha-o-2019.docx>.

- Vietnam News 2021, ‘Cryptocurrency continues to be attractive investment channel next year’, vietnamnews.vn, viewed 1 March 2022, <https://vietnamnews.vn/economy/1109949/cryptocurrency-continues-to-be-attractive-investment-channel-next-year.html>.

- Vietnam Science and Technology Forum n.d., ‘Fintech: Nắm bắt xu hướng để phát triển’, Vietnam Science and Technology Forum, Vietnam Science and Technology Forum, viewed 1 March 2022, <https://vjst.vn/vn/tin-tuc/4871/fintech–nam-bat-xu-huong-de-phat-trien.aspx>.