Healthcare is among the top spending priorities and fastest-growing sectors in Vietnam which accounted for 6.6 percent of total GDP in 2019. Spending on healthcare per capita is expected to triple from US$161 in 2018 to US$408 in 2028, but still relatively low compared to other Southeast Asia countries [1].

1. Key Drivers to Digital Healthcare Services

An emerging aging population and increased healthcare expenditure

According to the World Bank, Vietnam is the 15th most populous country globally and is expected to reach 120 million people in 2050. The elderly segment over 65 is also projected to triple to 21 percent in 2050 [2]. This demographic transition signifies a demand as spending on healthcare is expected to almost triple from US$15.6 billion (2018) to US$42.9 billion (2028), equating to the CAGR of 11 percent [3].

Rapidly expanding middle class and extensive digital enablers

By 2035, an estimate of over 50 percent of Vietnam’s population are middle class with access to digital literacy [4]. Vietnam sees the highest internet penetration in SEA at 69 percent[5]. 3G/4G/5G networks now cover over 95 percent of households and the country is heading towards cloud-based infrastructures, opening doors for cost-efficiency healthcare alternatives. This leads to a rise in demand for private, digital-integrated healthcare alternatives.

Increase burdens of non-communicable diseases (NCDs)

In Vietnam, people increasingly adopt unhealthy habits from more sedentary lifestyles, tobacco consumption, and binge drinking. As a result, non-communicable diseases, notably diabetes, cancer, and cardiovascular conditions, are becoming more common. The changing nature of illness translates to more demand for long-term and coordinated healthcare.

Government support and preferential tax treatment

In Resolution 20NQ/TW, the Vietnamese government has set 5 key national priority areas including public health, healthcare network, healthcare access, pharma and medical equipment innovation, and human resources. Allowance for doctors to offer telemedicine services to patients, subject to certain requirements including IT infrastructure and license, has also been established. From January 1st, 2021, preferential income tax, real estate, and credit laws have been issued as incentives to further investments in the healthcare and IT sectors.

2. Patients’ Pain Points and Growth Opportunities for Digitalization Entrepreneurship

Access

While the private healthcare sector is growing fast, Vietnam is still predominated by public hospitals from which services are constantly oversubscribed. As 65 percent of Vietnam’s population is located in rural areas[6], access to quality healthcare is geographically limited and time-consuming.

Quality

There are significant gaps in the standard of medical treatment and equipment between healthcare providers in major cities and rural provinces. Bed occupancy rates at central hospitals also far exceed the World Health Organisation’s recommended threshold of 80 percent.

Cost

Waiting time per average patient at public hospitals is relatively long whereas doctor-exposure time per visit is short. As a result, patients tend to pay multiple visits while their medical cases are not holistically reviewed.

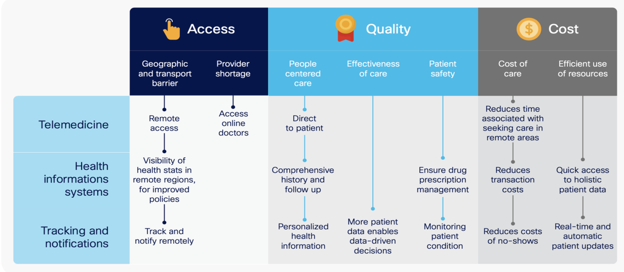

Figure 1: Digital health solutions in response to persistent health challenges across quality, access, and affordability [7]

Taking into account the abundant demand and digital trends of Vietnam’s healthcare industry, potential focuses for tech entrepreneurs arise. Startups should strive to adopt a patient-centric model wherein while both quality and costs matter, the goal should lie in patients’ health outcomes rather than those of the operational process. Furthermore, advantages are given to startups that can leverage big data to personalize their customer experience and invest in preventative treatments beyond sick care to increase customer lifetime value.

3. SEA Investment Landscape and Daunting Entry Barriers facing Startups in Vietnam

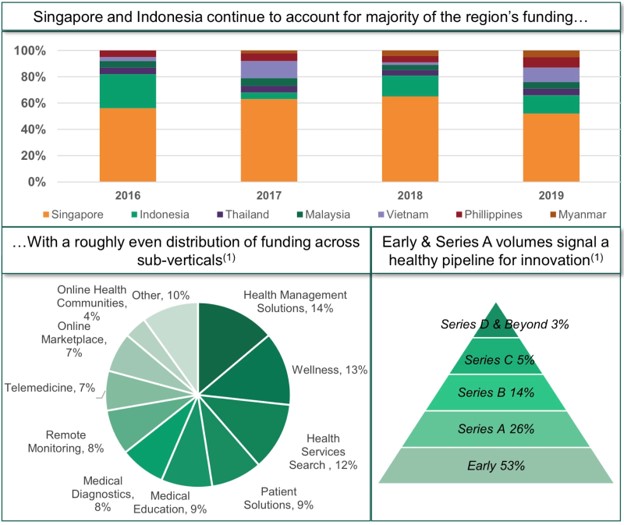

Healthcare expenditure in SEA is growing fast, even outpacing GDP [8]. The digital health industry experienced a funding surge in 2019 at US$266 million as deal volume grew by a CAGR of 63 percent [9].

Figure 2: Overview of SEA HealthTech Investment Landscape [9]

The ecosystem includes a wide range of services. While funding is evenly distributed across sub-verticals [9], the centerpiece of the ecosystem begins with telemedicine. Most ventures focus on delivering fundamental healthcare effectively with similar technology and business models. Some of the active investors in SEA include SequoiaCapital, Monk’s Hill Ventures, SG Innovate, Wavemaker, East Ventures, and OpenSpace Ventures.

In Vietnam, private healthcare is increasing, yet still out-dominated by the public side. Heathtech’s overall funding and entrepreneurial culture in Vietnam stands quite low compared to Singapore and Indonesia largely due to high entry barriers.

Vietnam lacks a transparent regulatory framework to protect intellectual property and a strong infrastructure for startups to scale. Specifically, 78 percent of programs were pirated in 2015 while piracy dropped to 74 percent in 2017 from 92 percent ten years earlier, indicating a slow improvement. The import rights for several product categories are reserved for state-owned companies, by which non-license holder companies must partner with licensed traders. Duty classifications for the same product may differ by office or the time of inspection. Problems regarding the clearance process such as arbitrary fees and the expectation of undocumented facilitation payments may also arise [10].

This results in startups, especially unfamiliar foreign entrepreneurs, relying more on middlemen navigators to run their business in the beginning, which draws additional cost and delays the process. Vietnam ranks 115 in the ease of starting a business category according to World Bank. The ambiguous nature and cumbersome administrative process delay equipment shipping to Vietnam and halt funding for startups as it discourages investors and private stakeholders to engage.

The adoption of digital solutions at public hospitals is challenging as healthcare professionals are conservative in implementing new technologies. A key differentiator in a startup’s ability to scale is how good its partnerships are, especially ones with the public sector. In Vietnam, JioHealth established referral partnerships with certain hospitals to combine online and offline healthcare services. While the demand from private sectors and direct patients is high, there is a significant lack of readiness from the public side largely due to unclear foundational regulations.

Entrepreneurial culture in the particular healthcare ecosystem in Vietnam is still in a nascent stage. Vietnam has many startup accelerators and incubators, mainly concentrated in Hanoi and Ho Chi Minh City. Even in these centers, there are none specifically focused on the healthcare sector. There is a lack of formal high-quality mentorship and entrepreneurs have to rely on personal networks for guidance and resources. Personal connections prove to be helpful in the early stages, yet a well-established ecosystem is crucial for startups to scale. Moreover, the collaborative link and innovation hub between research institutes, universities, and medical private sectors are overlooked.

4. Investment Registration Process in Vietnam

According to No. 67/2014/QH13 Law on Investment, a Foreign Investor and the Foreign Invested Enterprise (FIE) must complete a two-step licensing process, satisfying three-layer of conditions, before officially establishing an economic organization and providing trading services:

- Step 1: To apply and obtain an Investment Registration Certificate (IRC)

- Step 2: To establish an enterprise by obtaining an Enterprise Registration Certificate (ERC)

After obtaining the IRC and ERC, the FIE has to apply for sub-licenses depending on the nature of the business (e.g. Certificates of medical clinics for General consultation clinics, Specialized consultation clinics, Traditional medicine consultation and therapy clinics; or Medical equipment import Permit for Import of medical equipment).

Conclusion

COVID-19 has brought about an unprecedented global health crisis, pointing out the concerning debilitation in Vietnam’s healthcare systems. As care should not be centralized and limited to in-person sessions, a digital shift promises more access, quality, and cost-effectiveness. Vietnam, with its digitally savvy population and emerging economic growth, sees leading prospects in building a strong healthtech entrepreneurship ecosystem.

Written by Thu Do with support of consulting team (VICGO)

Reference

[1] Commonwealth of Australia, 2019, Digital Health in Vietnam: A Guide to Market, Australian Trade and Investment Commission (Austrade), viewed on 23 October 2021,

<https://www.austrade.gov.au/ArticleDocuments/4569/Digital%20Health%20in%20Vietnam%20Report.pdf.aspx>

[2] McKeering, D., 2017, The Digital Healthcare Leap, PwC, viewed on 23 October 2021,

<https://www.pwc.com/gx/en/issues/high-growth-markets/assets/the-digital-healthcare-leap.pdf>

[3] BMI, 2019, Pharmaceuticals and Healthcare Report, BMI

[4] Commonwealth of Australia, 2019, Digital Health in Vietnam: A Guide to Market, Australian Trade and Investment Commission (Austrade), viewed on 23 October 2021,

<https://www.austrade.gov.au/ArticleDocuments/4569/Digital%20Health%20in%20Vietnam%20Report.pdf.aspx>

[5] Google & Temasek / Bain, e-Conomy SEA 2019, 2019, Southeast Asia’s $100 billion Internet economy, Google & Temasek / Bain, e-Conomy SEA 2019, viewed on 23 October 2021,

<https://www.blog.google/documents/47/SEA_Internet_/>

[6] World Bank Data, Rural Population (% of Total Population) – Vietnam, The World Bank Group, view on 23 October 2021, <https://data.worldbank.org/indicator/SP.RUR.TOTL.ZS?locations=VN>

[7] ACCESS Health International Southeast Asia Ltd, 2019, Reaching 650 Million: How Digital Technology is Key to Achieving Universal Health Coverage in ASEAN, Cisco Systems, viewed on 23 October 2021,

<https://www.cisco.com/c/dam/global/en_sg/assets/pdfs/healthcare.pdf>

[8] Solidiance, 2018, The ~USD 320 Billion Healthcare Challenge in ASEAN, Solidiance, viewed on 23 October 2021, <https://www.solidiance.com/insights/healing/white-papers/the-usd-320-billion-healthcare-challenge-in-asean>

[9] Strauss, D., Bang, I., Liang, J., Wanchoo, M., Laitat, R. & Liu, Z., 2020, Southeast Asia VC HealthTech Landscape, INSEAD, viewed on 23 October 2021,

[10] EU Gateway | Business Avenues, 2019, Healthcare & Medical Technologies Vietnam Market Study, European Commission, viewed on 23 October 2021,

<https://www.eu-gateway.eu/file/43561/download?token=zEQwLKKz>