WHY VIETNAM?

A developing country with great potential for E-commerce

Being a developing country with a population of 98.56 million and the increase in the middle-income class as well as a high adoption rate of E-commerce during and after COVID-19 pandemic, Vietnam has become the potential country for developing the greatest E-commerce startups. Though crowded in the B2C sectors, there are potential startups in B2B E-commerce who have attracted a lot of attention from both local and foreign investors. Evidence for such interest is that in 2021, E-commerce came 2nd only to Fintech in the total amount of capital raised. The article aims to give an overview of the E-commerce Market in Vietnam, current startups that are the focus of attention from investors as well as the opportunities and challenges within the E-commerce sector.

I. OVERVIEW OF E-COMMERCE IN VIETNAM

Market size of E-commerce

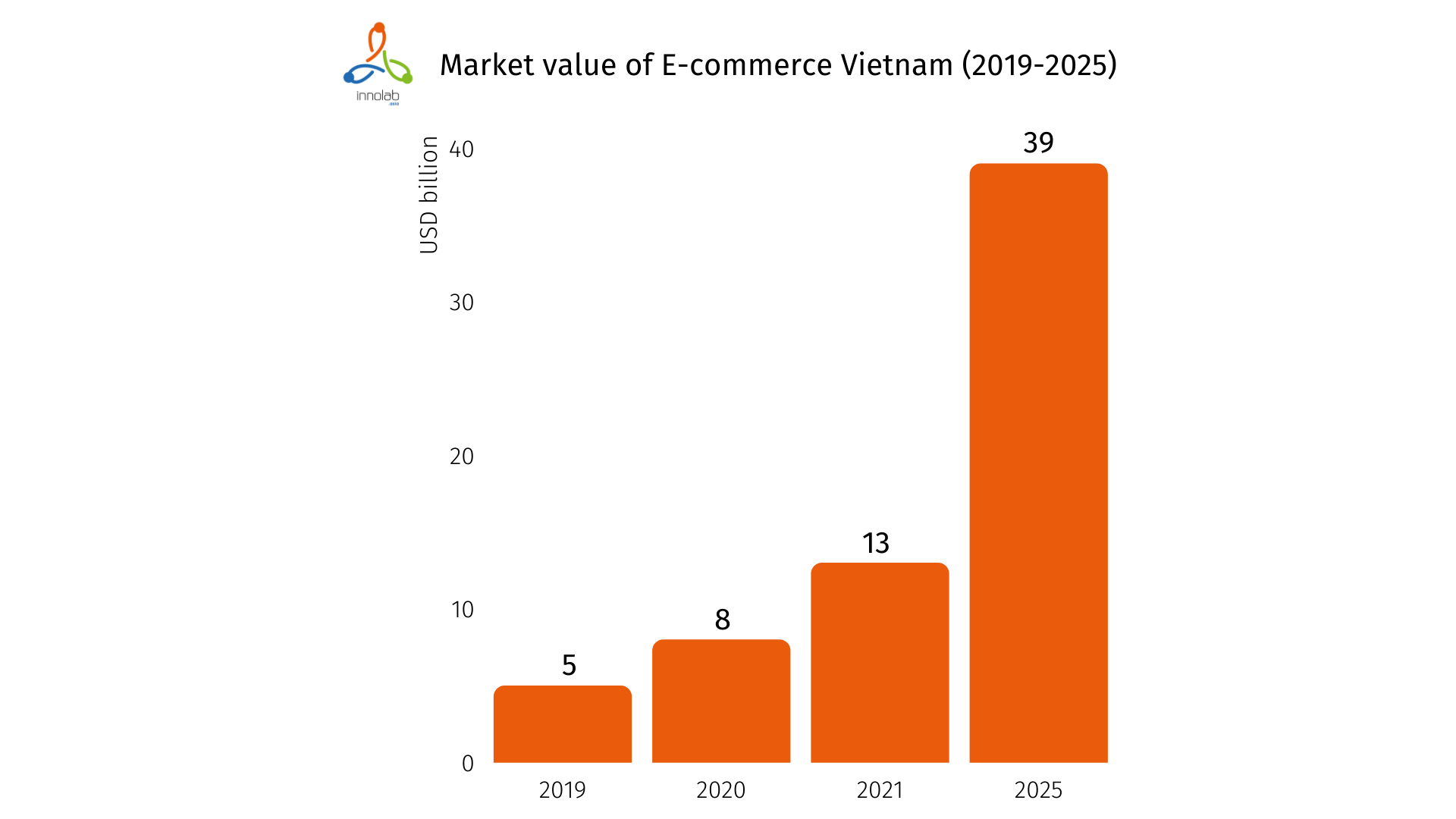

Source: Google, Temasek and Bain & Company

According to the Ministry of Industry and Trade (MOIT) of Vietnam, in 2020, the Vietnamese retail sector was valued at US$170 billion and is projected to achieve a compound annual growth rate (CAGR) of more than 10 percent in the next 5 year period (2021-2026). Also according to the MOIT, only in the first 2 months of 2022, the total retail sales of Vietnam reached 707,4 thousands of billion VND, which increased by 3.1 percent.

Taking a closer look, Vietnam’s e-commerce market has grown by 46% yoy, currently valued at $13B and is expected to reach $39 billion by 2025, according to a report jointly published by Google, Temasek and Bain & Co.

Growth of E-commerce

Source: Google, Temasek and Bain & Company

In comparison to other Southeast Asian countries, Vietnam is in the top 3 for retail growth, trailing only Indonesia. In terms of sales, Vietnam E-commerce is predicted to increase by 80% year over year and fivefold in the next 5 years. It has the largest expected growth in online retail GMV among Southeast Asian countries, at 4.5x between 2021 and 2026, while total SEA GMV is expected to quadruple in the following 5 years.

Users of E-commerce

1, Consumers cruise into a new way of life

Since the beginning of the epidemic (up to H1 2021), Vietnam has gained 8 million new digital consumers, with 55 percent of them originating from non-metro areas. By 2025, the number of E-commerce users in Vietnam is predicted to increase by 37% to 71 million. According to eCommerce DB’s estimate, Vietnam will also have the greatest user growth, with a 37 percent increase from 2021 to 2025, compared to China (24%), the United States (11%), and the United Kingdom (6%).

Source: eCommerceDB

Furthermore, because digital consumption has become a way of life, adoption stickiness remains strong. 97 percent of new customers are still using the services, and 99 percent plan to do so in the future. Users who used the services prior to the pandemic have consumed an average of 4 additional services since the outbreak, and overall satisfaction with the services is at 83 percent across verticals.

Source: Google, Temasek and Bain & Company

2, Rapid Growth in Consumer Spending is a Driving Factor

The disposable income per capita in Vietnam is predicted to rise rapidly, reaching USD 3,062 in 2023. Total consumer expenditure in Vietnam is VND 4.270 billion, expanding at the fastest rate in the area, at more than 8% per year. The private consumption rate is also high, accounting for more than 67 percent of GDP. This is the region’s second-highest rate, trailing only the Philippines (73.8%).

II. CURRENT SEGMENTS IN E-COMMERCE

- B2B E-commerce (business-to-business E-commerce). is defined as online sales of goods or services between businesses. Instead of receiving orders in the traditional ways (by telephone or mail), transactions are carried out digitally, which helps reduce a great amount of overhead costs. Some popular forms of selling B2B are wholesale, selling to resellers, large or chain retailers’ distributors, selling to organizations.

- B2C E-commerce (business-to-consumer E-commerce). is also called retail ecommerce – a business model that involves sales between online businesses and end consumers. B2C E-commerce is more popular nowadays due to the spread of popular E-commerce platforms such as Shopee, Lazada, Tiki, etc.

NOTABLE STARTUP DEALS IN E-COMMERCE

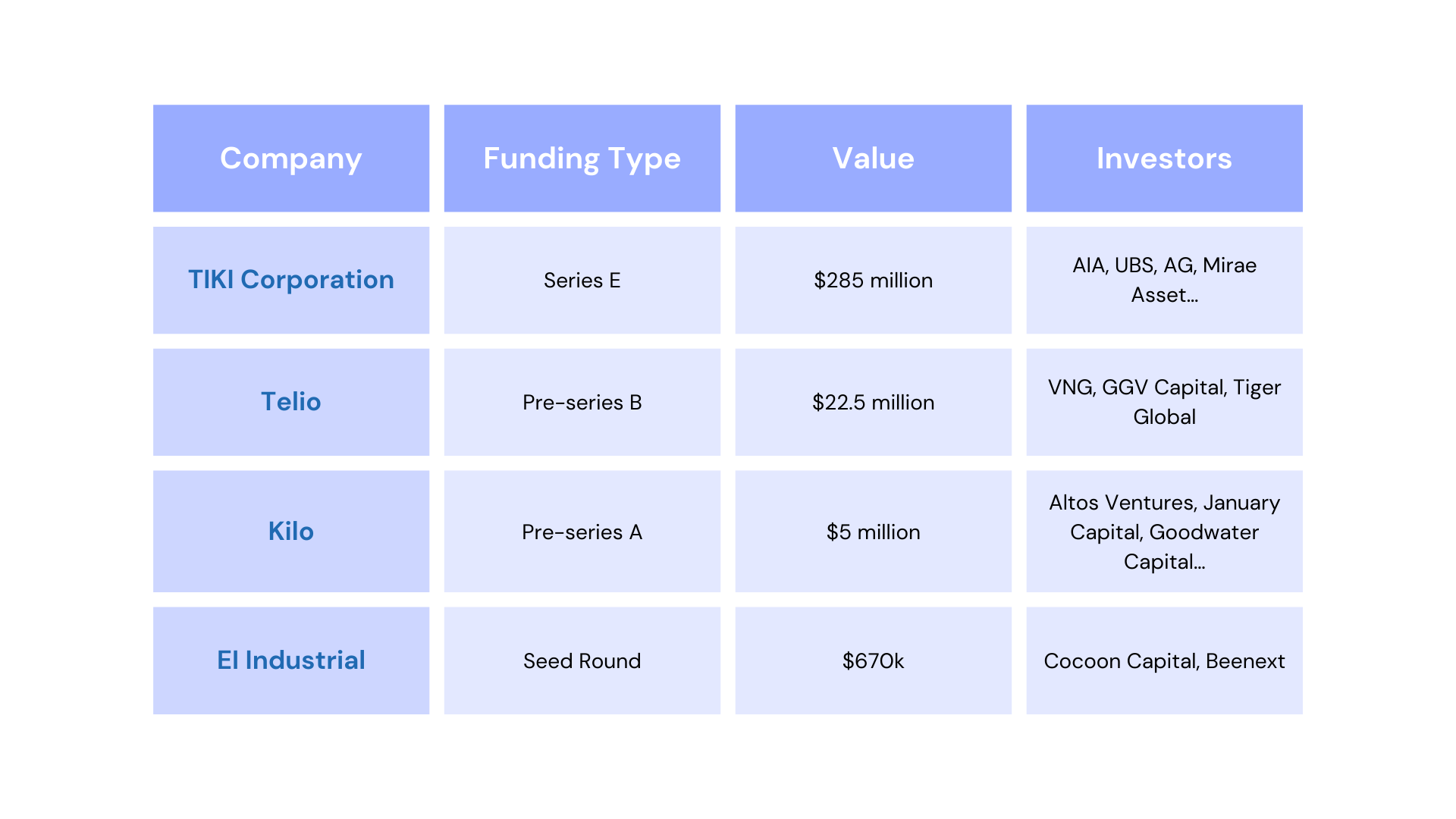

The deal value of 2021 has risen dramatically, owing to foreign and domestic investment as well as government incentives. According to the report by Nextrans (2021), E-commerce comes 2nd in receiving the capital funding, only after Fintech. That indicates that E-commerce is a potential area of investment, especially in developing countries like Vietnam.

There is a huge capital poured into the E-commerce startups with the most valuable deal of spotlight in 2021 belongs to Tiki, a local E-commerce platform in series E with $285M total funding. Among 4 deals given to the E-commerce sector, 3 of them belong to B2B E-commerce. The underlying reason is due to the diluted market for B2C E-commerce with dominantly 86% of the market belongs to 3 top players: Shopee (57%), Lazada (16%) and Tiki (13%), according to iPrice Group.

Source: Aggregate sources

2022 – a great beginning for retail too

On January 18th 2022, Con Cung – a Vietnam-based retail chain for maternity and baby-care products with over 600 fully-owned stores across 45 provinces and cities in Vietnam successfully raised $90-million from Quadria Capital, Asia’s leading healthcare investment firm. According to the announcement on Quadria Capital, Ewan Davis – managing director of Quadria Capital believed that during the pandemic, consumers are more aware of and prioritizing taking care of health. Global consumers increasingly focus on the health perspective when making consumer decisions, besides price and product quality. This contributes to motivating the fund to continue to empower healthcare-focused companies, to help them scale up.

“Having easy access to essential healthcare products and services is one such step. We see great potential in Con Cung to address such unmet needs and we have lined up several collaborations to help them penetrate the health and wellness segment, as well as further develop better mother and child-centric products and services.” said Ewan Davis.

III. OPPORTUNITIES AND CHALLENGES OF E-COMMERCE IN VIETNAM

OPPORTUNITIES

1, National E-commerce Development Plan for E-commerce

According to the Ministry of Industry and Trade of Vietnam, on May 15th 2020, the Vietnamese government approved the National E-commerce Development Plan for the 2021-2025 period. The plan focuses on achieving 5 goals:

- Support and promote the wide application of E-commerce in businesses and communities;

- Narrowing the gap between big cities and less developed suburbs in terms of E-commerce development;

- Building a healthy, competitive and sustainable e-commerce market;

- Expand the consumption market for Vietnamese goods within and outside the border by using E-commerce;

- Becoming one of the top 3 leading countries in Southeast Asia in terms of E-commerce market.

2, Digital payment become popular

Digital payment is gaining more and more popularity as a preferred transaction method on E-commerce platforms. This will help boost the cashless payment trend in conventional buying in stores.

According to records of Shopee, the total number of orders paid through Shopee Pay e-wallet across the region has grown fourfold. In which, the group of users over 50 years old is the group that supports the leap. This highlights Shopee Pay’s accessibility for an age that is generally thought to be resistant to digital payments.

3, Logistics will take the lead

Consumers anticipate more efficient deliveries in 2021. As a result, firms and retailers must properly employ technology to ensure that things are delivered fast and cost-effectively. To do so, the entire process must be monitored from approval to delivery, to the logistics network and warehouse capacity.

Shipping is key to many online shopping platforms. It has been incorporated into Tiki’s growth strategy in 2021. Richard Trieu Pham, CFO of Tiki, revealed that the platform invests tens of millions of dollars each year in technology and logistics, a figure that is projected to rise in the future. For Shopee, Shopee Express expanded its reach in 2020 to serve more users, particularly those in remote areas. Many firms took advantage of Shopee’s logistical infrastructure, resulting in a threefold increase in the amount of items transported from the warehouse.

CHALLENGES

The B2C E-commerce sector is maturing, which poses a significant barrier for new businesses to enter the market.

Because Shopee, Tiki, and Lazada have such a significant market share, it is more challenging for startups to get into the B2C market when consumers are accustomed to purchasing on these platforms. Furthermore, these organizations must begin to focus on profit-generating rather than traffic or just the quantity of users, otherwise they risk following the failures of Lotte.vn and Adayroi.

REFERENCES

1, Google, Temasek and Bain & Company 2021, e-Conomy SEA 2021 report: Roaring 20s: the SEA Digital Decade, services.google.com, viewed 14 March 2022, <https://services.google.com/fh/files/misc/e_conomy_sea_2021_report.pdf>.

2, iPrice Group 2021, E-commerce Q2 2021: Vietnamese’s Interest in Online Grocery Stores Is Skyrocketing, iprice.vn, viewed 14 March 2022, <https://a.ipricegroup.com/media/Duy/Content_MKT/MoE_Q2_2021/EN_-_E-commerce_Q2_2021_Vietnameses_Interest_in_Online_Grocery_Stores_Is_Skyrocketing__1_.pdf>.

3, Ministry of Industry and Trade of Vietnam 2020, Phê duyệt Kế hoạch tổng thể phát triển thương mại điện tử quốc gia giai đoạn 2021-2025, Moit.gov.vn, viewed 14 March 2022, <https://moit.gov.vn/van-ban-phap-luat/van-ban-dieu-hanh/-phe-duyet-ke-hoach-tong-the-phat-trien-thuong-mai-dien-tu-q.html>.

4, Nextrans Vietnam 2021, Vietnam Industry Report 2021, Nextrans Vietnam.

5, Quadria Capital 2022, Quadria Capital Invests US$90 Million into Con Cung – Vietnam’s Leading Mom and Baby Retailer, Quadria Capital, viewed 14 March 2022, <https://www.quadriacapital.com/quadria-capital-invests-us90-million-into-con-cung-vietnams-leading-mom-and-baby-retailer/>.